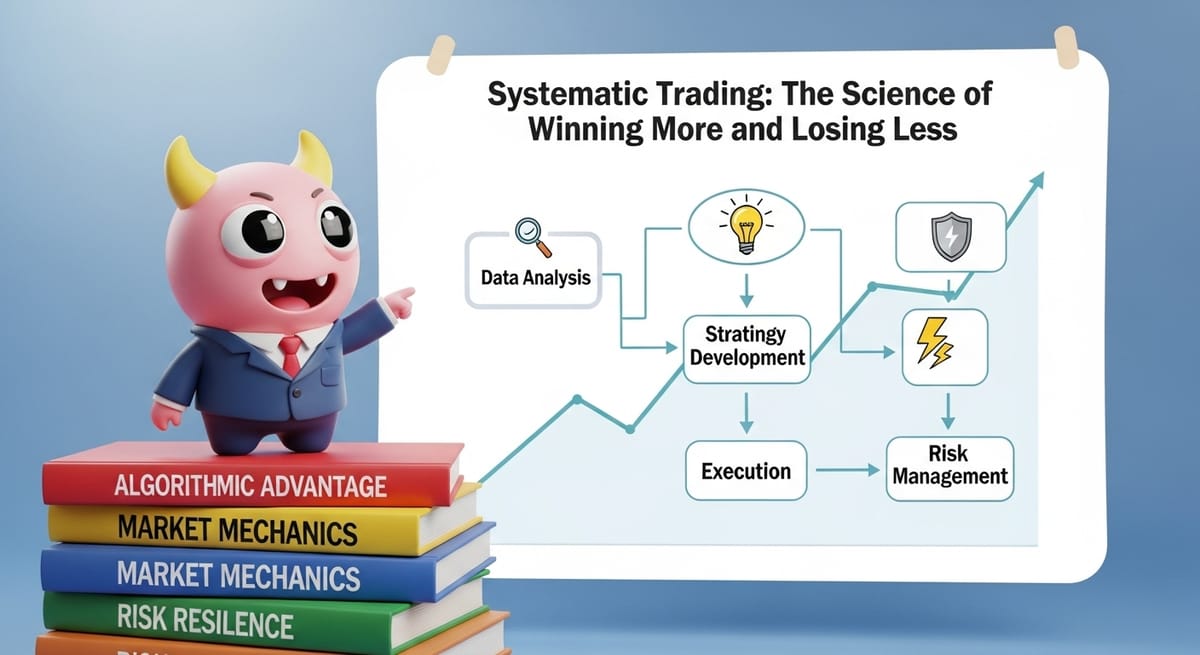

Systematic Trading: The Science of Winning More and Losing Less

Welcome to the 86th edition! In this issue, discover how systematic methods, artificial intelligence, and end-of-day strategies can boost your performance—plus, decide if short-term trading is really right for you.

Insider Edge: Latest Trading Buzz

- Systematic Trading: The Science of Winning More and Losing Less

📊 See how data-driven systems and disciplined processes give traders real advantages—and how you can start: Systematic Trading | QuantInsti 🧠

- How AI Is Transforming Stock Trading—From Analysis to Automation

🤖 Uncover the future of trading as artificial intelligence powers new insights, speed, and accuracy: AI in Stock Trading 🚀

- End-of-Day Strategies: Trade Smarter, Not Harder

🌙 Find out how evening routines can outsmart the markets and fit your busy schedule: End of Day Trading Strategy 🕰️

- Short-Term vs. Long-Term: Which Trading Approach Is For You?

⚡ Explore the key differences, pros, cons, and risks to help you choose your best fit: Short-Term Trading Guide | CMC Markets 📚

US stocks rebounded late in the week after early losses driven by AI bubble concerns and rotation out of tech. Major indexes ended mixed, with the S&P 500 and Nasdaq posting gains on Thursday amid cooler inflation data boosting rate cut hopes.

Cooler Inflation Fuels Rally

November CPI showed inflation at 2.7%, the lowest since July and below 3.1% forecasts, while core CPI eased to 2.6%; this lifted the S&P 500 0.8% to 6,774.76 and Nasdaq 1.4% on Thursday. Markets now eye potential Fed cuts in January despite prior scaling back.

Tech Volatility Persists

AI-linked stocks like Broadcom pressured Nasdaq early, down 0.6% Monday, but Micron surged 10% on strong earnings and guidance; Oracle rose 5% after-hours on TikTok acquisition reports. Nike plunged 10.8% after weak China sales in earnings, while DJT jumped 42% on fusion energy merger news.

Sector Rotation and Year-End Outlook

Small caps and value outperformed amid tech pullback, with Dow up slightly weekly despite 1% monthly dip; gold and silver hit records on rate hopes. Investors await Santa rally potential into year-end amid low volumes.

Market Outlook: December 22–26, 2025

Overview

The Christmas week of December 22–26, 2025, features thin trading volumes amid holidays, with markets closed Christmas Day (Dec 25) and minimal activity on Boxing Day (Dec 26). Focus shifts to U.S. Q3 GDP final, PCE inflation, RBA minutes, UK GDP revisions, PBoC rate decision, and Japan CPI, testing year-end positioning post-Fed cuts and amid tariff price pressures.

Key Themes and Drivers

1. U.S. Data Highlights

Final Q3 GDP (Tue, Dec 23) and Core PCE (same day) cap inflation/labor debates after Fed's 3.5-3.75% range. Consumer Confidence (Tue) gauges holiday spending amid PMI hiring slowdowns and tariff spikes.

2. Central Bank Signals

PBoC rate decision (Mon, Dec 22) eyes stimulus at 3.00%; RBA minutes (Tue) detail December hold amid wage moderation. BoJ Governor Ueda speech (Thu) previews hikes.

3. Global Releases

UK GDP revisions (Mon), Japan CPI (Thu) test BoE/ECB/BoJ paths. Thin liquidity amplifies moves in holiday-shortened sessions.

4. Seasonality and Risks

Santa Claus rally potential clashes with frothy S&P (20x fwd P/E), AI exhaustion, and consumer defensive overvaluation (11% premium).

Key Events Calendar

Market Sentiment and Risks

- Equities: Value/small-caps lead; defensives overvalued, tech at risk post-AI run.

- Bonds: Yields stable; PCE surprises key pre-2026.

- Currencies: USD resilient; AUD/JPY sensitive to CBs.

- Commodities: Oil pressured (~$55/bbl 2026); gold hedges tariffs.

Bottom Line

Thin holiday liquidity amplifies U.S. PCE/GDP and CB signals amid Santa rally hopes vs. frothy valuations. Favor quality/defensives; brace for volatility in low-volume sessions.

Inability to consistently attend investor education events

With a jam-packed schedule, finding time to attend workshops, seminars, or webinars to boost your investing skills feels impossible. The Trading for Busy Professionals newsletter brings the education directly to your inbox—condensed, clear, and actionable insights from top experts, so you never miss a beat in your investment journey.

Ready to keep learning on your own time? Click here to join the newsletter and get expert knowledge delivered when it suits you best!

Final Key Takeaway

True trading success comes from the right habits and tech—master core skills, automate when you can, and always protect your downside. Let the right mix of skill and innovation shape your profits, now and in the future!