Are Weekend Trades Your Golden Ticket or a Fast-Track to Loss? The Truth Revealed!

Welcome to the 57th edition of our newsletter! This issue breaks down the strategies, tools, and habits that smart traders use to win big—from managing trades through unpredictable weekends, to building bulletproof trading plans, harnessing the latest algorithmic tech, and maximizing time to boost forex profits. Dive in for practical guides and expert insights designed to help you trade smarter, act faster, and stay ahead in today’s dynamic markets!

Insider Edge: Latest Trading Buzz

Are Weekend Trades Your Golden Ticket or a Fast-Track to Loss? The Truth Revealed! 🕒⚡

Find out whether holding trades over the weekend delivers big rewards or unexpected setbacks—and how to avoid disaster—by reading this must-see guide here! 🚀

Unlock the Blueprint for Trading Success—Build Your Perfect Trading Plan Now! 📋💡

Master the key steps to creating a reliable trading plan and level up your results—learn the essentials here! 🎯

Is Your Strategy Outdated? Upgrade Your Game With the Best Algo Trading Tools of the Year! 🤖📈

Discover the top algorithmic trading tools to automate, optimize, and supercharge your trades—explore the cutting-edge options here! 🏆

Dominate Forex Like a Pro: Master Time Management for Lasting Profits! ⏰🤑

Learn the essential time management tips every forex trader needs to maximize efficiency and returns—get the actionable advice here! 💪

Spotlight on Devon Energy Corporation (DVN)

Current Price: ~$34.51 (as of September 8, 2025)

Market Cap: ~$21.9 billion

Dividend Yield: ~2.8%

Sector: Energy – Oil & Gas E&P

Why Devon Energy Draws Attention

1. Resilient Performance and Solid Returns

Devon Energy is a leading U.S. independent exploration and production company operating major assets in the Delaware Basin, Eagle Ford, Anadarko, Williston, and Powder River Basins. Over the past quarter, DVN shares are up 15%, reflecting solid operational performance and heightened investor optimism. The company’s return on equity stands at a robust 19%, signifying effective capital allocation.

2. Financial Highlights

- Revenue (ttm): $16.1 billion

- Net Income (ttm): $2.84 billion

- EPS (ttm): $4.44

- P/E Ratio: 7.8

- Dividend: $0.96 per share (2.8% yield); ex-dividend date: Sep 15, 2025

- 52-Week Range: $25.89 – $43.30

- Forward P/E: 9.0

Devon holds a competitive net income margin (8.1%) and strong inventory turnover, supporting its ability to navigate oil price cycles.

3. Strategic Moves and Growth Initiatives

- Portfolio Optimization: Recent acquisitions (notably Grayson Mill) strengthen production and reserve base.

- Capital Discipline: Ongoing focus on debt reduction, buybacks, and sustainable dividend policy.

- Operational Focus: Ambitious plan targets $1 billion in annual pre-tax free cash flow by 2026.

Growth Catalysts

- Oil Price Upside: Higher oil prices could significantly boost profitability and free cash flow.

- Acquisitions: Integration of accretive deals to enhance scale and basin competitiveness.

- Capital Returns: Attractive dividend and buyback program signal confidence in future cash flows.

- Efficiency Gains: Cost optimizations and technological advancements enhance margins.

Risks to Consider

- Commodity Price Sensitivity: Earnings remain highly sensitive to swings in oil and gas prices.

- Technical Headwinds: Weak technical score and bearish indicators caution against near-term entries.

- Policy and ESG Factors: Regulatory and environmental pressures could impact medium-term growth.

- Debt: While improved, leverage must be managed as the energy landscape evolves.

Analyst Sentiment & Outlook

| Metric | Value/Estimate |

|---|---|

| 12-Month Price Target | $44.32 (avg.) |

| High Price Target | $57.00 |

| Low Price Target | $33.00 |

| Analyst Consensus | Buy |

| Dividend Yield | ~2.8% |

| P/E Ratio | ~7.8 |

- Analyst consensus is positive with 44 analysts rating DVN a “Buy,” and price targets indicating ~27–30% upside from current levels.

- Technical caution in the short term; medium- to long-term prospects improved by operational execution and industry positioning.

Bottom Line

Devon Energy offers value and income through disciplined capital allocation, a strong asset base, and proven management—yet remains cyclical and subject to near-term market technicals. For investors bullish on oil prices and seeking a blend of yield and growth potential in energy, DVN represents a worthy candidate, best suited for those with a moderate risk tolerance and a longer time horizon.

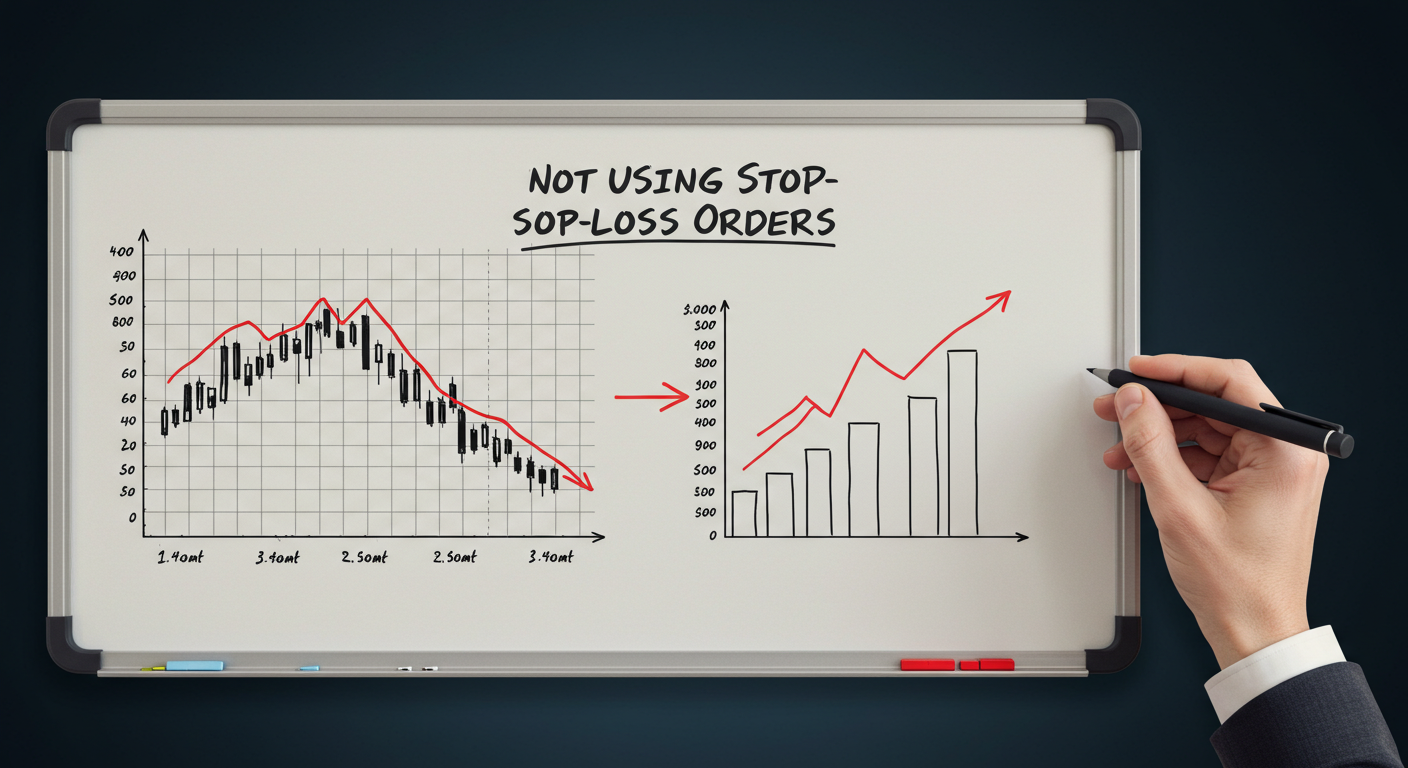

Not Using Stop-Loss Orders

Failing to set stop-loss orders can lead to bigger losses when markets turn—something busy investors can’t afford. The Trading for Busy Professionals newsletter guides you on smart stop-loss strategies to protect your downside without constant monitoring.

Shield your portfolio with smart risk controls—join the newsletter today and trade safer, even on your busiest days!

Final Key Takeaway

Winning traders don’t rely on luck—they build robust plans, stay disciplined, leverage modern tools, and invest their time wisely. Whether you’re evaluating weekend risks, constructing your next strategy, embracing algorithmic trading, or sharpening your time management, every smarter step you take brings you closer to consistent success. Make every trade and every minute count—your advantage starts now!